What is FRM ? Career, Exam, Certification, Benefits In 2024

This post will explain what does frm mean. Financial Risk Manager (FRM) is an expert designation awarded by the Global Association of Risk Professionals (GARP) to the candidates who successfully complete this certification program. It is a worldwide recognized standard for those who manage danger.

What is FRM ? Career, Exam, Certification, Benefits In 2024

In this article, you can know about what does frm mean here are the details below;

With the quick changes in the finance market worldwide there is a need for specialists who manage risk, money, and investment to acquire internationally standardized up-to-date understanding and FRM aims to fill that gap. Also check jmeter alternatives.

FRM Certification Requirements

There are no instructional or expert requirements to stand for the FRM Exam. It is practice-oriented assessment used in 2 parts; concerns are created to relate theory to practical, real-world, problems. Nevertheless, to end up being a Certified Financial Risk Manager, candidates must comply with the following outline of the program:

In order to become a Certified Financial Risk Manager after passing the FRM Exam Part I & II, candidates must demonstrate a minimum of 2 years of risk-related full-time expert experience positions including portfolio management, danger consulting, and other fields.

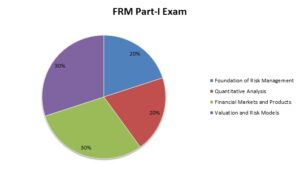

FRM Part I Exam

Clearing the FRM Exam Part I is the first step for a private to become a Certified Financial Risk Manager. The prospects are expected to learn about the danger management principles and theories as they would apply to a risk manager’s daily work. The Part I test focuses on the important tools and principles required to examine financial threat. This examination is offered in the month of May and November each year. There are 100 several choice questions to be attempted within the duration of 4 Hours. The below diagram portrays the subjects that the prospects are expected to get ready for in level I exam with their respective weight age.

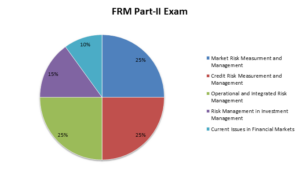

FRM Part II Exam

The Financial Risk Manager Exam Part II is the second of two exams that a prospect needs to clear to end up being a certified FRM. The FRM Exam Part II concentrates on the practical application of threat management tools covered in Part I to particular locations of danger management such as credit danger, market danger, and operational danger. This examination is offered in the month of May and November each year. There are 80 multiple option concerns to be attempted within the duration of 4 Hours. The listed below diagram portrays the topics that the candidates are expected to get ready for in level II examination with their particular weight age.

FRM Career Opportunities

The FRM certification separates you from your peers, offers a competitive advantage to coworkers, clients, and prospective companies. It provides the chance for people to accelerate their careers regardless of their instructional background. It helps the prospects with specialized knowledge and abilities in financial threat management. It supplies you with a network to connect with the world’s prominent financial threat management specialists. It supplies with diverse career choices in Risk Management, Trading, Structuring, Modeling, and so on. FRM holders can have positions such as Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Director, Investment Risk Management, to name a few. It is an excellent value addition to abilities, credentials, and resume

Provide financial guidance and service to clients. Identify the crucial skills of a successful wealth supervisor. Provide reliable monetary services to customers. Also check catia software.

Industries Employing Certified FRM’s.

Prospects for the FRM designation operate in any variety of markets, including:.

– Banks.

– Investment banks.

– Asset management companies.

– Corporations (including non-financial corporations).

– Consulting firms.

– Hedge funds.

– Insurance companies.

– Credit companies.

– Government/regulatory firms.

– Risk and technology vendors.

Frequently Asked Questions (FAQ).

– How much time exists to prepare for the FRM Exam?

This will differ with individual’s previous experience, idea familiarity, and academics background, Therefore, it is tough to offer a specific number of hours to prepare for this exam. Nevertheless a study in May 2012 FRM Exam Part I test takers indicates that, on average, people committed about 240 hours to Exam preparation though it differed from less than 100 to more than 400 hours.

– What are my profession chances after becoming a Certified FRM?

There are different profession prospects readily available as it is one of the most widely accepted designations in danger management industry. It provides a competitive edge as versus other peers. It is a valued designation by employers worldwide. FRM holders can have positions such as Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Director, Investment Risk Management, to name a few. It is a fantastic value addition to abilities, credentials, and resume.

– How much work experience is needed prior to requesting the FRM Exam?

To become a Certified FRM, individuals need to have expert experience of two years in risk-related full-time expert experience positions including portfolio management, threat consulting, and other fields. Nevertheless, there are no instructional or expert requirements to look for the Financial Risk Manager Exam.

– When can one stand for the exam?

Part I & Part II tests are available on 3rd Saturday of May & November each year.

– Are there any exemptions offered by GARP for either part of the exam?

Though there are lots of other reputed expert designations in the financial services industry, GARP does not accept other designations in partial satisfaction of their requirements. To keep the integrity of the FRM certification and to satisfy their responsibilities to the risk management neighborhood, for that reason, GARP can not count on the evaluations performed by other designation-granting companies. Thus, there are no exemptions that are used to students for either part of the examination.

– If prospects stand for Part I and II in one day and do not pass Part I, Part II are not marked. Why so?

The Financial Risk Manager Exam tests cumulative knowledge, principles tested in Part I is needed for Part II. Hence to grade Part II, a prospect should initially clear Part I. Hence, if a candidate has actually appeared for both Parts I and Part II on the very same day, will not be graded for Part II unless a candidate has passed Part I. Also the prospect will have to re-take Part I till they pass.

– Is use of calculator permitted during the examination?

Yes, it is permitted to use specified financial calculators (TexasI Bachelor’s Degree II Plus or expert and HP 12C).

– What is the mode of examination for both Part I and Part II exam?

Both the examinations would be manual via paper and pencil.