8 Best Payroll Software Tools In 2022

This post will explain payroll software. If you are looking for a means to handle your payroll, like many small businesses in the US, you have certainly noticed there are many different software alternatives available. No small business owner likes to deal with payroll. Although doing it by hand has almost completely disappeared, it is still a time-consuming activity that diverts your attention from your main responsibilities as a business owner.

Payroll services are often extremely inexpensive when everything is said and done. Payroll services are less expensive than bookkeeping and consulting.

We often suggest that we are – in some manner – associated with our client’s payroll as a company that provides payroll services for small businesses.

It is simpler for us to offer financial advise and much simpler for our clients’ quarterly and annual bookkeeping and returns when we are familiar with all of their accounts and are aware of what their payroll expenses are.

Despite this, we continue to suggest that our clients use payroll software.

If our customer uses software we can automate with another platform like Quickbooks or Qvinci, whether it is just for data input or a comprehensive payroll system that employees use to clock in and out, it makes our jobs lot easier.

Using payroll software also makes it simpler for you to budget spending and determine the number of hours your staff are working.

What Features Should My Payroll Software Have?

This is a frequently requested query that normally depends on your company.

We frequently inquire about the following issues:

- Do you require time-tracking/clocking in and out functionality in your payroll software?

- Do you wish to be able to submit your year-end or quarterly forms?

- Do you require a straightforward or intricate interface/user experience design?

- What is your acceptable price range for payroll software?

8 Best Payroll Software Tools In 2022

In this article, you can know about payroll software here are the details below;

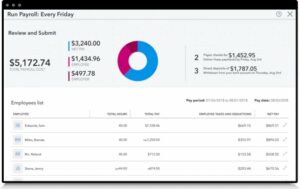

1. QuickBooks Payroll

Best for: Small businesses that are currently using Quickbooks Online or Desktop or those searching for a well-known payroll software solution. Also check virtual assistant.

Nowadays, Quickbooks has essentially monopolised the accounting sector and has become the industry standard. This is another payroll software.

Nearly all accounting firms provide Quickbooks accounting services, or at the very least are well familiar with how it operates.

Because of this, it’s simple for your accountant to incorporate into their procedure when you use Quickbooks to manage the payroll for your little corporation.

We advise trying Quickbooks Online software before you sign up for payroll since if you don’t like their primary services, using their payroll software can be a waste of time and money.

WHAT IS THE PRICE OF QUICKBOOKS PAYROLL SOFTWARE?

- Self-Serve The monthly payroll is $35 ($17.50 for the first three months) plus $4 per employee.

- Full-Service The monthly payroll is $80 ($40 for the first three months) plus $4 per employee.

Features of Quickbooks Payroll Software:

- Direct deposit, accessible always

- Submit your forms through Quickbooks straight at the end of the year.

- Determine pay checks

- W-2s are prepared and delivered to you*

QUICKBOOKS PAYROLL SOFTWARE: WHERE CAN I USE IT?

- Internet-based browser

- A portable app

- Desktop software

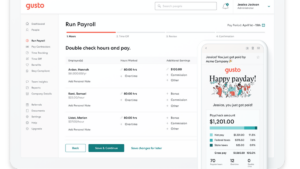

2. Gusto

Best for: Small businesses seeking for an attractive Quickbooks substitute In recent years, gusto has gained popularity. We frequently hear from clients that they were dissatisfied with Quickbooks, which is why they are now using Gusto to handle their payroll. Also check sites like reddit

Gusto was created solely for payroll, whereas Quickbooks provides a vast array of accounting and financial capabilities.

Another well-liked feature of Gusto is its time tracking tool, which makes it simple to administer things like employee hours, vacation time, and PTO rules.

Whereas Quickbooks is largely for business owners, Gusto is a payroll solution that is focused heavily on teams.

Gusto can be used for a variety of important human resources functions, including corporate surveys, employee onboarding, document storage and sharing, and much more. This is another payroll software.

Gusto wasn’t created just for small business owners. Gusto enables management and access for accountants, greatly simplifying the process for both you and your accountant.

WHAT IS THE PRICE OF GUSTO SOFTWARE?

Small businesses wishing to test out their payroll software can use Gusto’s free 1-month trial. The pricing is then as follows:

- Monthly Core costs $39 plus $6 per employee.

- Complete costs $39/month plus $12/monthly employee.

- Concierge costs $149 per month plus $12 per employee each month.

Features of Gusto Payroll Software:

- Integration with Quickbooks

- Full-service, comprehensive payroll

- Self-service capabilities and employee profiles

- Vacation and Paid Time Off policies

- Mobile or desktop time tracking *

- The administrator can assign authorization to specific staff

- Special offers and employee onboarding

- A list of your staff members

- Staffing surveys

- W-2s are prepared and delivered to you*

- A trained human resource expert was assigned

ARE THE GUSTO PAYROLL SOFTWARE AVAILABLE ANYWHERE?

- Internet-based browser

- A portable app

- Desktop software

3. Freshbooks

Best for: Small enterprises or individuals who must keep track of their time and bill clients according to the amount of time spent on each assignment.

Another cutting-edge payroll system is Freshbooks, which was created using a broad range of accounting and financial technologies. Freshbooks is unquestionably the finest option on this list for new businesses, independent contractors, and anyone who might recruit contractors or part-time workers. This is another payroll software.

Freshbooks is a wonderful tool for invoicing and project collaboration in addition to being a wonderful payroll solution. You can track your own hours in addition to those of your employees in order to bill clients.

With Freshbooks, you may make projects (or customers). Then, you, an employee, or both can keep track of time spent on particular projects or clients.

These hours can then be sent directly to your client. Additionally, your customer can pay you directly using Freshbooks. The calendar for employees and the business is one of our favourite features.

It gives you a bird’s-eye perspective of the hours your staff are working and the projects they are expected to work on. Also check payroll services.

WHAT IS THE FRESHBOOKS SOFTWARE PRICE?

Small businesses interested in trying out Freshbooks’ payroll software can do so for one month without paying anything. The pricing is then as follows:

- The cost of Lite is $15/mo plus $10/monthly employee (5 clients max)

- Complete costs $25/mo plus $10/employee/mo (up to 50 clients)

- Premium ($50/mo Plus $10/employee/mo; maximum of 500 clients)

Features of Gusto Payroll Software:

- Integration with Quickbooks

- Countless personalised invoices

- Expense reporting

- Recede payments made by bank transfer and credit card.

- Automatic bank synchronisation

- Timekeeping

- Client retention fees

- Reminders for late payments *

ARE THE GUSTO PAYROLL SOFTWARE AVAILABLE ANYWHERE?

- Internet-based browser

- A portable app

- Desktop software

Others That We’ll Add To Our Payroll Tool List

4. Rippling

A cutting-edge payroll tool for compensating staff, independent contractors, and freelancers

5. SurePayroll

As a Paychex family member, SurePayroll can be for you if you currently utilise Paychex.

6. Zenefits

Zenefits is a terrific tool for human resource departments and has the greatest user interface of all the payroll software on this list.

7. Namely

With a collection of payroll, time tracking, and onboarding features, Namely is another platform designed to simplify things for human resource departments.

8. Ascentis

Excellent for payroll, time tracking, and human resources departments once more.

Need Aid in Selecting Software and Payroll Organizational Methods?

We are a St. Louis-based small business accounting firm, but we work with companies all around the country.

We would love to articulate with you about managing your company’s payroll because we are always assisting both new and current clients.

You can get in contact with us and we would be pleased to help, whether you require a full-service payroll business to handle your time tracking and payroll or just need help getting started.

Payroll Required For Your Franchise?

Volpe Accounting specialises in franchise accounting and can assist you in getting off to a good start.