Paycor Login Account Employee Login Complete Guide

This post will explain Paycor Login. This section will cover practically all of your questions if you work for a business that works with Paycor or are a payroll or HR administrator utilising Paycor software.

Paycor Login Account Employee Login Complete Guide

In this article, you can know about Paycor Login here are the details below;

Visit the Paycor Support Center to get in touch with Paycor if you don’t see your query listed here, or use our expanded knowledge base. Also check regions online banking

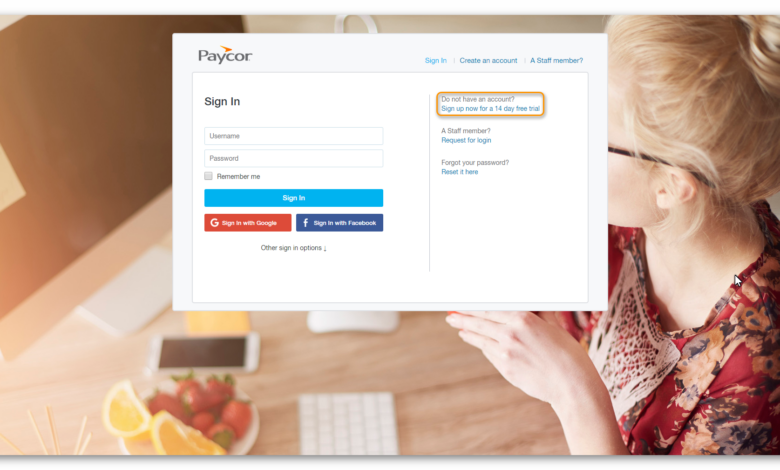

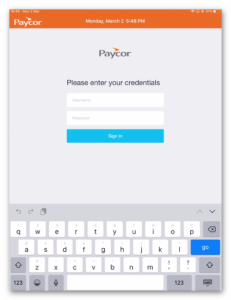

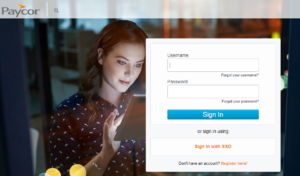

Paycor Login

Here are some useful hints for viewing your employee information in Paycor.

- Click Sign In on the www.paycor.com website.

- Click the Sign In button after entering your User Name and Password.

- Float over Me.

- Next, select Profile Summary.

- |amp|

- You can access certain information about yourself here, such as your contact data, paystubs, and compensation history.

Change password:

- Use your current password to log in at https://hcm.paycor.com/authentication/signin.

- In the top right corner, select My Settings.

- “Change Your Password” is a link that can be found under Security.

- Password forgotten or unknown:

- Visit www.paycor.com and select the Sign In option.

- Leave the Username and Password fields blank.

Forgot or don’t know your password:

Then adhere to the directions displayed on screen.

- Updated data on direct deposits:

- We can support you there.

Update direct deposit information:

To modify your direct deposit information, you must first have permission from your employer’s HR or payroll administrator. Also check adp workforce login

- Navigate to Profile Summary in the menu.

- Select Compensation.

- Navigate to Direct Deposits.

- Refresh your knowledge

- Please contact your company administrator if you require assistance right away.

When will my W-2 be available?

All W-2 forms will be mailed by Paycor before the end of January.

After leaving Paycor’s offices, your W-2 will be accessible online at www.paycor.com in four days (roughly around the same time you receive a physical copy in the mail). At that time, you can download or print your W-2 from www.paycor.com.

Note: Get in touch with your employer’s HR administrator if you can’t access your W-2 online or haven’t gotten a hard copy by January 31.

For Administrators

How to find your client ID:

Go to the Pay Employee or Configure Company menu options on the Company tab to obtain your client ID.

You can see the client ID to which you are signed in at the top, underneath the tabs.

Additionally, if you go to the Home tab, you will see your current Client ID directly below the blue “Contact Us” button.

New employee info, taxes:

In order to use a tax code for an employee later on, it must first be added at the corporate level.

Modify the Calculate setting to ON or OFF to change whether a tax is being calculated for an employee at the moment. Also check hdintranet

Steps:

- Then select Manage Employees.

- The worker who is getting a new deduction.

- From the left navigation menu, select Compensation.

- The system will show the employee’s default information and any taxes that have already been assigned.

- Make any alterations required.

- After reviewing the settings, click Save.

How to set up a 1099 employee:

The most typical reason someone receives a 1099 is because they work as an independent contractor for a business.

Depending on where the revenue is originating from, different 1099 types may apply.

Independent contractors, interest and dividends, withdrawals from retirement accounts, rent, royalties, and even some government payments are common sources of 1099s.

Steps:

- Configure the proper 1099 earning code

- Adjust the settings and then save

- Add the employee to the policy.