Best 15 Most Important Financial KPIs You Should Be Tracking In 2024

This post will explain Financial kpis. How often do you look into the financial health of your business? No, we are not just discussing looking at the revenues of your business alone. We mean the complete picture and that includes whatever from your net profits to sales figures to stock to consumer complete satisfaction and more! Most people in organization just check their company’s net income at the end of the month and then attempt to come up with methods to broaden their company.

Best 15 Most Important Financial KPIs You Should Be Tracking In 2024

In this article, you can know about Financial kpis here are the details below;

However if you truly desire a reliable method to grow and expand your company, then you require to have a clear insight of the financial well being of your company. For that, you must to be following financial metrics & financial essential efficiency signs (KPIs).

If you are wondering what that suggests, then don’t stress. This blog will assist you comprehend everything you require to know about financial KPIs so that you can make better financial choices.

What are Financial KPIs?

Let’s start with what KPI implies.

KPI is short for crucial efficiency indicator, which is a numerical value that measures the efficiency of your company. It suggests whether your company is making any development or development with its targets. Also check Customer value.

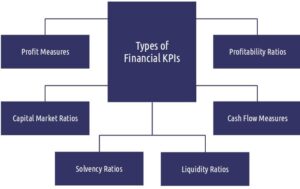

So, financial crucial efficiency signs or financial KPIs determine the general financial performance of your business.

They supply you with all the details you need to learn about the expenses, sales, earnings, and capital of your organization so that you can make decisions that will help you accomplish all your financial objectives and objectives.

Why You Should Track Financial KPIs?

Let’s face it, you can not kid around when it comes to financial resources. Your company functions for the main purpose of earning earnings. So, it is very important that you track your business’s financial health if you are truly major about making money and expanding your business.

That’s why financial KPIs exist– they are indications that provide you measurable measures about your business’s financial health!

You must always watch out for them if you truly care for your organization due to the fact that:

– They offer fact-based and mathematical metrics of your business’s financial efficiency

– Helps you examine the success of your company

– Spots the areas in your service that requires improvements

– Helps you forecast your company’s future profits and incomes

– Prepares your company to deal with any issues or risks that may develop

– Successfully compete with other companies and industries

– Improve the total financial health of your business through increased incomes

By comprehending financial KPIs, you can be in a much better position to know about how your organization is carrying out from a financial perspective.

They are whatever you require to accomplish your financial goals!

Wish to know more regarding financial KPIs?

Then grab a pen & paper because we are going to dive into a list of financial KPIs you should be tracking to help you comprehend your business’s financial health!

Index of Financial KPIs You Should Be Tracking:

1. Running Cash Flow

Operating cash flow is the count of the overall quantity of cash produced from a business’s day-to-day organization operations. It includes all the inflows and outflows linked to your service activities such as profits (from sales, refunds, and so on) and expenditures (wages, fines, charges, etc).

It is a financial KPI that offers you a much deeper insight into your company’s financial health by exposing whether your organization operations are making sufficient capital for further capital investments to keep or grow your operations.

2. Gross Profit Margin

If there’s a financial KPI that you require to track to understand the financial status of your service, then it’s your Gross Profit Margin It is simply the total earnings of your business minus the expense of goods offered (the direct expenditures connected with your product).

When you evaluate the gross profit margin, it informs you whether you have priced your items properly or not and whether you have actually produced an item that is better than your competitors. It’s a simple method to measure your business’s profitability and likewise its production effectiveness throughout the years.

3. Net Profit Margin.

If you need to know how well your service is doing at turning income into revenues, then Net Profit Margin is your monetary KPI for it. Your net profit is the quantity of cash left after you have paid all your direct & indirect expenditures. This divided by your overall earnings is your net profit margin. Also check Consumer psychology

It determine how reliable your service has actually been in transforming your profits into profits. It also reveals your firm’s possible net worth based upon your incomes and likewise forecast your future revenues.

The greater your net profit margin, the much better off your business is.

4. Working Capital

Working capital is the distinction between your business’s existing properties such as money, accounts receivable, and so on and your current liabilities such as loans, accounts payable, and so on. It reflects your company’s available properties that can cover your short-term financial dedications.

Working capital is a great financial KPI since it can measure your company’s functional effectiveness and efficiency and likewise helps you identify any money-related concerns before you run into financial problems. This in turn assists you in financial reporting and analysis.

A high working capital doesn’t suggest your company is succeeding as it can also imply that you are not investing your additional cash.

5. Current Ratio

How do you know if your organization remains in a position to meet all its financial responsibilities on time? You compute its existing ratio. It is an essential financial KPI that determines your business’s short-term financial health and tracking it may provide you a warning of cash flow issues.

It is calculated by dividing your present assets such as cash, inventory, pre-paid costs, etc by your present liabilities such as accounts payable, charge card debt, taxes, etc. It determines your company’s ability produce enough to settle any debts.

The greater your existing ratio, the more capable you are of paying your expenses in the short term.

6. Quick Ratio

Next on the list is the short ratio, a very important financial KPI that assesses the financial health and wealth of your company. It is also understood as the acid test ratio due to the fact that it produces instant results.

This KPI is stronger than the existing ratio because it does not consist of properties that are not liquid such as stock. This indicates that it determines your company’s immediate liquidity and cash-on-hand to satisfy short term financial liabilities. So, if your quick ratio is more diminutive than your present ratio, it suggests that your present possessions depend upon your inventory.

The greater your fast ratio, the much better your liquidity & financial health.

7. Return on Equity

If you have shareholders, then replace on equity is a terrific financial KPI that lets you compare your company’s success with its competitors and examine its financial standing in the market. It indicates how much earnings your company generates with your investors’ financial investments in your business.

Return on equity KPI is determined by dividing your company’s net income by your investor’s equity. This lets you determine your organization’s profitability and measures its functional and financial management effectiveness. The bigger the recovery on equity, the more efficient your company is.

8. Return on Investment

Roi (ROI) is among the most regularly utilized financial KPIs in company due to the fact that it extremely basic and versatile. It is a step of the cash acquired from an investment compared to the amount of money invested. Basically it informs you whether your financial investment deserved it.

ROI can be utilized to assess your business’s profitability and effectiveness in regard to the investments you make. It likewise assists calculate worth of cash into a specific task and helps you select the very best financial investment options for your business.

9. Burn Rate

Burn rate is an extremely appropriate financial KPI if you have a small company. It is the rate at which your firm expends cash within a definite amount of time even before it can produce a positive capital. In short, it is the currency you spent monthly.

This KPI indicates your month-to-month costs and assists you figure out just how much cash your company needs to continue operating and growing. It also computes the quantity of time your company has before it lacks money and assists make the necessary prepare for fundraising and cutting costs. Also check key2benefits

10. Accounts Payable Turnover

What if you could see out if your business is doing a good task at settling its providers? Accounts payable turnover does just that! It divides the total cost of sales throughout a period with your average accounts payable for that duration. This lets you determine the rate or speed at which you settle your providers.

This financial KPI lets you follow the time your business takes in finishing your payments so that you can take the required actions to keep your standing with your vendors. This likewise suggests the variety of times your company has paid off its accounts throughout a repaired course of time, therefore helping you comprehend your business’s financial health.

11. Accounts Receivable Turnover

The accounts receivable turnover suggests the rate at which your service collects payments due from its consumers. It is determined by dividing your overall sales for a duration by your typical receivables for that duration.

It’s a great financial KPI that informs you to make changes in managing receivables to bring payments within proper time and also assists you measure how successfully your business has the ability to extend credit to clients. The greater the ratio for your balance dues turnover, the better it is for your company as it is an indicator that your consumers are paying you faster.

12. Inventory Turnover

It may be difficult to monitor your inventory as it is something that continually goes in and out of your warehouse. That’s why keeping track of it will assist your company’s sales strength and production performance. The inventory turnover KPI assists you do this by determining your company’s ability to offer and re-stock its inventory during a particular time period.

It is an excellent financial KPI due to the fact that it shows the efficiency of your supply chain, the quality and need of your stock, and the fairness of your purchasing practices. It likewise helps you determine how arranged and efficient your organization is in managing merchandise and how excellent it is at producing sales and increasing earnings.

13. Debt-to-Equity Ratio

The debt to equity ratio shows the total disadvantages of your service with your shareholders’ equity. It gauges how well you are utilizing your investor’s financial investments and how much of your funding and growth is dependent on borrowings or financial obligations.

It is an important financial KPI due to the fact that it assists you get insights into your organization’ equity and liability, and assists you concentrate on your financial accountability. A lower financial obligation to equity ratio indicates that your business does not rely on its shareholder’s equity or creditors for financing financial obligations.

14. Budget Variance

Spending plan variance is the difference between the budgeted or designated figures and the actual figures for a particular accounting category. This distinction could be due to elements such as poor budget preparation, altering organization conditions, natural catastrophes, labor expenses, and so on.

This financial KPI is utilized to assess whether your budgeted amounts meet your expectations and help you prepare your budget plans bearing in mind the various internal and external aspects that affect them.

15. Client Acquisition Ratio

Your customers easily help you comprehend the financial health of your service, after all, your business depends on them. That’s why the client acquisition ratio is an excellent financial KPI that you ought to keep an eye out for. It assists you measure how much revenue you receive for each brand-new consumer you obtain.

You can calculate your consumer’s anticipated life time profit with the cost of obtaining them. If the investment ratio is below one, then it’s a failure for your service, however if it’s higher than one, then it implies that your investment deserved it and you are increasing your business’s earnings.

Conclusion

Who understood there would be numerous financial KPIs, right? However, if you noticed, they are all very different. That’s due to the fact that each financial KPI caters to the needs of various kinds of organizations. So today it is up to you to make the right choice for your business.