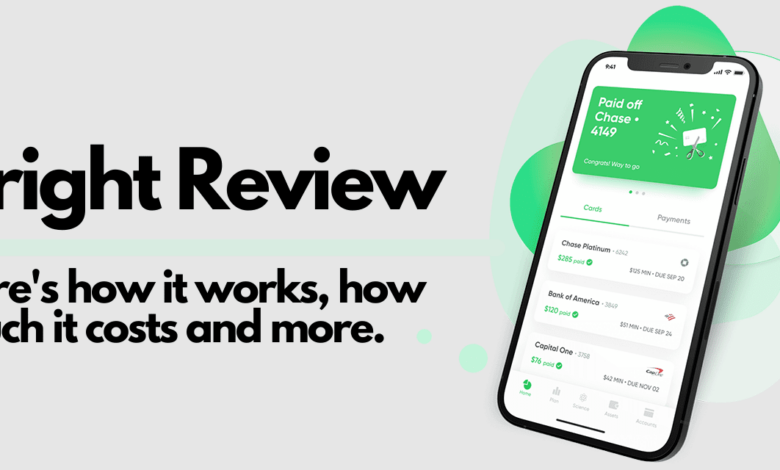

Bright Money Review – Is The Application Worth It To Pay Down Credit Card Debt?

This post will explain Bright money review. If you’re struggling to settle charge card financial obligation, you might be searching for services that can streamline the procedure. Bright Money is an application that can help you attain your financial goals even if you’re living paycheck to paycheck.

Our Bright Money review will go over how the service operates, its charges, functions and more to assist you determine if the app is right for you.

Bright Money Review – Is The Application Worth It To Pay Down Credit Card Debt?

In this article, you can know about Bright money review here are the details below;

Bright Money was produced to help you pay down debt much faster, build savings and enhance your credit history. The application automatically scans your checking account, adjusts to your costs routines day by day, and then transfers funds to assist you fulfill your financial goals.

What is Bright Money?

Bright Money was founded with the objective of supplying monetary services anybody can use. In order to create customized plans for its users, the app is driven by expert system (AI).

The company’s objective is to double the wealth of middle-income consumers by helping them make better financial decisions.

By integrating information science and behavioral style, Bright Money’s artificial intelligence (AI) can assist middle-income earners improve their financial image.

The app achieves its objective by producing a trifecta of financial target objectives you can carry out. These include saving money, paying off debt & improving your credit history. Also check how to get personal loan.

How Does Bright Money Work?

Bright was produced for those who are having problem with credit card financial obligation and paycheck-to-paycheck living. In fact, when you register for Bright Money, it will ask you what your top monetary objective is.

Your choices are:.

– Pay off credit card financial obligation.

– Improve your credit score.

You can also choose cost savings goals at a later point, such as constructing an emergency fund or saving for a getaway.

Once you connect your bank account to Bright, it will evaluate your earnings and costs practices.

From there Bright will transmit small amounts of money from your bank account to your Bright account (called a Bright Stash account).

Then, it will systematically utilize that money to assist you accomplish your financial objectives of paying off charge card debt and/or conserving money.

If you cope with a low balance in your bank account, Bright has your back and utilizes its MoneyScience AI to automatically react. As your financial resources shift or if you have upcoming expenses, Bright changes how much & when it withdraws money from your checking-account.

These small steps will help you break the paycheck to paycheck lifestyle. In return, you will improve your credit score in addition to your overall financial scenario.

Bright Stash.

Your Bright Stash-account is an interest bearing account that saves the transfers made from your separate, current checking account.

From Bright Stash, the MoneyScience innovation AI figures out when to use your Bright Stash funds to make payments on your financial obligation.

It will likewise determine when to make additions to your savings account objectives or your investment funds.

If you are concerned about security, do not stress. Bright Stash is FDIC guaranteed.

Customized Financing.

With Bright Money, you have complete control over how & when money is designated to your Bright Stash account.

You can choose to money your Bright Money account by:.

– Allowing Bright Money’s AI to move money to Bright Stash as it pleases.

– Setting a regular transfer schedule into your Bright Stash account.

– Having Bright Money move money to your Bright Stash account on paydays.

– Moving money to your Bright Stash account manually as you choose.

You can utilize one of these allowance alternatives. Alternately, you can combine several as it fits your lifestyle.

Just How Much Does Bright Expense?

Bright has 3 membership strategies, and each option has the same features. However, you can save money on membership charges by selecting longer strategy terms.

Here are the membership plans and their rates:.

– Monthly: $14.99 per month.

– Semi-annual: $53.94 two times a year (averages out to $8.99 monthly).

– Annual: $83.88 per year (averages out to $6.99 monthly).

Each subscription choice includes a totally free 10-day trial.

Furthermore, all membership plans featured Bright’s money-back warranty. This guarantee states that if you are not pleased with your account, Bright will refund your membership charges.

Key Features of Bright Money.

Bright Money has numerous functions that can help you settle charge card debt, conserve money and enhance your credit report.

Personalized Financial Strategy.

Possibly Bright Money’s most attractive feature is that it utilizes expert system to help you develop a customized financial strategy using its trademarked MoneyScience technology.

MoneyScience was built on 33+ algorithms with the help of 120 financial experts. Plus, it’s been checked by over 50,000 users.

As pointed out, your MoneyScience plan can help you accomplish 3 primary goals, including settling financial obligation, enhancing your credit and conserving more money.

You choose which goals are essential to you and how those objectives are attained.

Bright Money’s AI algorithms help figure out when you have additional money to spare to put toward your financial objectives.

From there, it will put the additional money into your Bright Stash account, then assign the money towards your monetary goals.

Customizable Debt Reward Methods.

You can pick from 3 different debt benefit strategies when you are tailoring your Bright Plan.

These benefit techniques consist of:.

– Financial obligation snowball: Pays debt off in order from most affordable balance to highest balance.

– Financial obligation avalanche: Pays financial obligation off in order from highest to lowest interest charge.

– Personalized reward order: Pay off debt in the order you choose.

The custom-made debt reward choice suggests that you can create the Bright Plan that works best for you.

Note that in writing, you can only settle charge card with Bright. You can not settle other types of financial obligation, such as car loans and mortgages.

Cost savings Objectives.

Bright lets you set a range of savings objectives. Then, it assists you to money those goals by transferring money from your Bright Stash account to your cost savings pods when it pleases.

Examples of cost savings objectives you can set and achieve with Bright include:.

– Rainy day funds.

– Vacation funds.

– New car funds.

– Home down payment funds.

Or any other savings objective you might have. You get to pick your target goal date, and Bright does the rest. Also check Short term loan bad credit

Credit Score Enhancement.

Bright Money uses its MoneyScience innovation to help you enhance your credit score.

Your credit history is based on 5 primary aspects, consisting of:.

– Payment history.

– Credit utilization ratio.

– Length of time you’ve had your debts.

– How much brand-new credit you’re opening.

– Type of debts you have.

Bright Money’s MoneyScience innovation understands which charge card to pay down in what order if you are seeking to increase your credit score as rapidly as possible.

When you choose to let Bright Money choose how your charge card are paid off, it will use payments in a manner that minimizes your credit usage ratio. In return, that will help improve your credit rating.

Bear in mind that if you pick your own approach to pay off your credit cards, you might not view as fast of an increase in your credit report.

You can even view your credit rating and monitor the improvement on your own.

Bright Credit Builders.

The platform likewise provides a simple credit increase with its Bright Credit Contractor. It runs immediately, creating a new credit line Bright utilizes to assist settle your charge card and repays to the credit line immediately.

The result is an automatic favorable payment history that improves your credit rating. It’s safe to use and risk free. You’ll put down a $49.9 deposit for the line of credit and get it back in full when you’re done.

Bright Balance Transfers.

Another element of Bright Money is its Bright Balance Transfers. This is essentially a credit line that offers a lower interest rate than what you’re paying on your charge card.

You can transfer your charge card balances to that credit line to assist you pay less in interest and pay your financial obligation off quicker.

It’s possible to get credit lines as much as $10,000 with APRs as low as 9.95%. Nevertheless, this will depend on your eligibility.

Client Reviews.

If you are trying to identify if Bright Money is right for you, knowing what other users think of the app might assist.

Here is how Bright-Money ranks on the numerous score platforms:.

PlatformRatingNumber of Reviews.

Trustpilot4.5 out of 516.

Apple App Store4.7 out of 52,700+.

Google Play4.7 out of 53,500+.

These are a few reviews that clients shared across the rating sites:.

” Bright Money is outstanding! Amazing experience and Client assistance are fantabulous! I like the way the app is developed!”– Jenny John.

” I’m so thankful I found Bright! It’s all I will ever need for charge card management. The algorithm is seamless. I never ever realize the money has been gotten rid of from my bank account. My cards are all-paid on time or earlier.”– Chelzzz3.

” I’ve only had this applicatio for a few weeks and I’m already impressed. Text messages to keep you notified of your account statuses and fast customer care for your questions. I ‘d advise.”– Katharine Brown.

Alternatives to Bright Money.

Given That Bright Money is a more recent app, we have actually consisted of a couple of alternatives for you to take a look at.

Qoins.

Qoins can also assist pay off your financial obligation, and you can include savings objectives. But it’s not as vibrant as Bright’s AI, which gets used to low balances in your checking and even expects other upcoming bills.

With Qoins, you can choose 4 options for funding the account that will assist you settle financial obligation or save money.

These include:.

– Weekly transfers.

– Roundups on debit card purchases.

– Transfers on paydays.

– Smart Cost savings.

The Smart Savings feature will automatically move money to your Qoins account based on your choices.

As money builds up in your Qoins account, Qoins will direct that money to help you attain your goals of paying off debt, conserving your money or both.

Qoins has 2 various membership plans:.

-$ 2.99 monthly to pick one goal (pay off financial obligation or save money).

-$ 4.99 monthly to bundle and pick both goals.

Bear in mind that if you have more than one financial obligation to settle, you’ll require to pick the $4.99 each month strategy.

Tally.

Tally works likewise to Bright Money, although it also doesn’t expect and change for other upcoming bills. The service assists you settle your financial obligation by letting you choose from 3 various membership options.

With Tally Membership, you connect your charge card. Then, Tally assists you pay them off in the most intelligent way possible. This choice costs $4.99 monthly.

Tally Basic contains all of the Tally Membership features. It likewise offers a lower interest credit line that you can utilize if you wish to move your credit card balances so you can pay them off faster.

The Tally+ strategy uses a bigger line of credit at a steeper discount. Both the Basic and the Plus strategy come with a $300 annual fee that is subtracted from your readily available credit line.

Frequently asked questions.

If you are still on the fence about Bright-Money, these concerns might be able to assist.

Is Bright Money protect?

Yes. Bright Money utilizes 256-bit encryption bank-level security and partners with Plaid to keep your information protected. It doesn’t share data with third parties.

Additionally, Bright accounts are FDIC insured approximately $250,000. This implies you can rest easy knowing your money is safe. Also check Financial kpis

Does Bright Money deal with all banks?

No. While it does not work with everybody, Bright Money deals with a wide variety of banks. In overall, the service deals with over 14,000 banks.

Check the Bright Money site to see if your bank partners with Bright.

Does Bright Money deal with all charge card?

No. Bright Money works with many charge card that have in between 13 and 19 digits. If your credit card will not sync with Bright Money, call Bright’s client service number for support.

How can I get in touch with Bright Money customer service agents?

The business has customer service agents offered 24/7.

Summary.

Bright Money is an app that you can use to assist settle credit card financial obligation, improve your credit score and save money for short-term monetary goals.

If you’re having a hard time to save money and settle credit card financial obligation, Bright Money could be the solution you require to obtain on much better monetary footing.