5+ Best BNPL Apps In 2022

This post will explain best bnpl apps. The best Buy Now Pay Later (BNPL) apps that are user-friendly and have low interest rates are listed in this blog. Apps that allow users to make purchases now and pay them off later (BNPL) are becoming more and more common.

These apps are comparable to credit cards in that they let you make a purchase today and spread the cost over time in manageable instalments.

The fact that many apps don’t charge interest as long as you make the required payments is one of the biggest differences, though.

They have become popular solutions for both in-store and online buying because to their simplicity of use, cheap fees, and interest-free payments.

And in a time when many people struggle to make ends meet, these apps enable people to make investments that they otherwise wouldn’t be able to.

We have assessed the top buy now, pay later apps based on a number of criteria, including features, interest rates, and ratings, to assist users in selecting the best BNPL apps in 2022.

Users are increasingly turning to the several BNPL suppliers that have developed in recent years to buy everything from clothing to travel to exercise equipment.

Choosing the best BNPL apps for oneself, however, may be challenging given the abundance of apps available nowadays.

But don’t worry; we’ve compiled a list of the best buy now, pay later apps in this post that are simple to use and have cheap fees and interest rates.

Best BNPL apps for iOS and Android users

5+ Best BNPL Apps In 2022

In this article, you can know about best bnpl apps here are the details below;

Apps with favourable ratings, features, and platforms are included in the list.

1. Sezzle, One of the Best pay later apps without KYC

The only BNPL app that has the potential to raise your credit score is Sezzle.

The catch is that upgrading to Sezzle Up is only possible with on-time payments.

Sezzle’s fundamental strategy is typical. This is another BNPL Apps.

Pay in four zero-interest payment choices over the course of six weeks.

With this strategy, Sezzle doesn’t provide credit bureaus with payment history information.

However, Sezzle Up does track your purchases and payment history, and you might get a bigger credit limit.

Additionally, Sezzle and Ally are working together to offer long-term financing options.

These interest-bearing loans enable substantially larger purchases over longer periods of time.

Characteristics of Sezzle

On Sezzle or Sezzle Up, there is no interest rate.

Sezzle Up aids in credit score improvement.

Zero late fines

Get discounts on premium brands.

2. Perpay, one of the best pay later apps for students

In 2019, Inc. Magazine ranked Perpay as the fifth-fastest growing private firm with more than 3 million users.

Perpay employs checks and balances to prevent financial loss but does not screen consumers based on their credit histories. This is another BNPL Apps.

It accomplishes this, for instance, by setting a user’s spending budget restriction based on their income level.

Instead of connecting a credit or debit card to your account to make the instalment payments, Perpay enables you to connect your paycheck.

Your fee schedule will be determined by the day you get your company’s paycheck.

An instalment will be automatically delivered to the BNPL service each time you receive a paycheck.

Important aspects of Perpay

The Perpay marketplace offers more than 1000 products.

Boost your credit score by an average of 39 points with Perpay+.

Limits on spending depending on current income

Choose the frequency and number of payments.

Get the best BNPL app by downloading it.

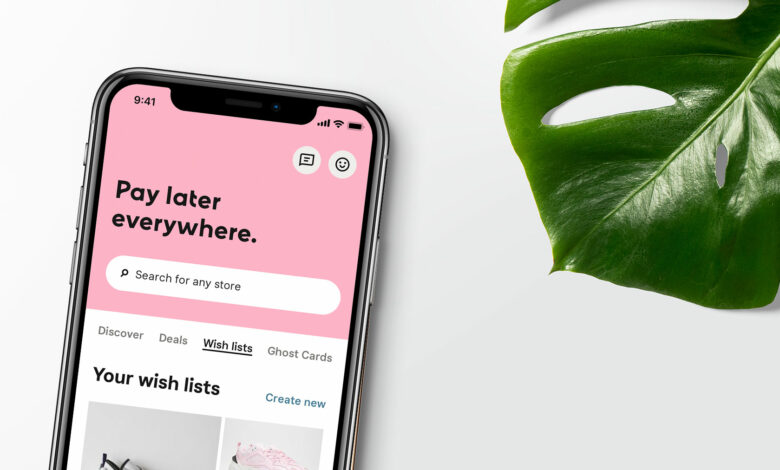

3. Klarna, the most Popular BNPL app

Since its founding in 2015, Klarna has grown to include 145 million active users and more than 40,000 merchants in 45 nations.

Adidas, Lenovo, H&M, and other well-known retailers are among those that accept Klarna for BNPL.

You can use the Klarna app to make four interest-free payments or pay the entire sum in full without interest within 30 days.

The service provider may use a collection agency to recover their money if your account defaults.

For larger goods, you can choose financing for six to 36 months.

This longer-term choice does include an interest component.

Important aspects of Klarna

Distribute the cost of your purchase across four smaller, interest-free payments.

Utilize special offers and discounts to save money.

Get 24-hour client service.

Access more than 4,000,00 merchants

Shop from premium manufacturers like Adidas, H&M, and more.

4. Affirm, One of the best apps for buy now pay later

One of the best apps for “buy now, pay later” is Affirm, which enables you to purchase nearly anything from any retailer that accepts Visa. This is another BNPL Apps.

Choose the provider at the checkout when you are ready to purchase a product.

You can view your payment options, including interest rate, monthly amount, and number of instalments, if you are pre-qualified.

The majority of loans can be paid back interest-free in three, six, or twelve months (only interest).

In some circumstances, longer durations (up to 36 months) can also be possible.

In addition, there are no prepayment penalties, late fees, or service charges.

Important aspects of Affirm

No late fees or penalties for early payment

May receive immediate loan approval

Acquisitions up to $17,500

Select the payment schedule based on your need.

5. Afterpay, One of the best BNPL apps in 2022

One of the best pay later apps, Afterpay, provides a quick and easy application process that might or might not entail a mild credit check. This is another BNPL Apps.

They provide a 0% interest rate and don’t report a customer’s purchases or payment history to the credit reporting agencies.

However, Afterpay’s standout features are those intended to curb excessive spending and encourage frugal behaviour.

For instance, as a result of your history of timely payments, your purchasing limit keeps increasing.

To make sure you never forget to make a payment, the app also includes automatic payment reminders.

Important aspects of Afterpay

After the initial application, there is no credit check.

Interest rates are 0%

Purchase limit rises when payments are made on time

Doesn’t provide payment or purchase history to credit bureaus

6. PayPal, One of the best BNPL apps for free

PayPal was founded in 1998 and is a US company based in California that enables users to send money domestically and internationally as well as make secure online purchases through websites and mobile apps.

For BNPL, the business offers “Pay in 4” instalment services. This is another BNPL Apps.

Users of PayPal who are 18 years of age or older and have active accounts are eligible for this feature.

You can easily divide your purchase into four manageable payments using PayPal’s Pay in 4 feature.

The rather charge must be made at the time of purchase, and after that, payments must be completed every two weeks until the entire purchase is repaid.

You’ll be able to tell if a purchase qualifies for Pay in 4 once you complete the PayPal checkout process.

When using the Pay in 4 services, which are available for purchases between $30 and $1,500, no interest is assessed.

Key characteristics of PayPal

Four payments without interest

Useful at countless retailers and works best for small purchases

Simple to use

7. Lazypay, the best afterpay app

The buy now, pay later option from Lazypay is becoming more and more well-liked.

A wide range of products, including cabs and food deliveries, are supported by this feature.

Lazypay has a very user-friendly interface, and registration only needs a few financial and personal information from you.

If the transaction exceeds $10,000, Lazypay offers its users flexible EMI options, ranging from 3 to 12 months.

You also have the choice to avoid paying interest by making your payment within 15 days.

Important aspects of Lazypay

Payoffs are made once every 15 days.

Without interest

Free credit score monitoring

Access free EMI options for expensive purchases.

Install the top afterpay app.

iOS

8. Zip, the most popular BNPL app

Customers have the option to pay with no interest over four instalments with 3.9 Zip (formerly Quadpay). Clients have more control over their repayment schedule with this, one of the best BNPL apps. Weekly, biweekly, or monthly payments can be established. You are only permitted to spend $1,500 on Zip (but maximum amounts vary by retailer). This is another BNPL Apps.

Zip does not report these loans to the credit bureaus, like the other BNPL providers. Additionally, it doesn’t run credit checks on clients before approving them for a loan. Zip has connections with more than 50,000 businesses worldwide, including Apple, Zara, and ASOS. Customers can also shop at stores that are not integrated with Zip by using the app or the browser extension. The fact that Zip charges a convenience fee is one of its biggest disadvantages.

Customers of Zip pay a $4 order fee or $1 for each payment they make. Interest-free pay in four instalments is one of Zip’s standout features.

- Enjoy a single, easy login

- Control your expenses.

- Find discounts and Zip only offers.

- Many people now use BNPL as their preferred method of payment.

- It has won the trust of many because to its unmatched transparency and lack of hidden fees.

- With their flexible repayment schedules and 0% interest on all credit obtained, the BNPL apps described above are some of the best competitors on the market.

- If any of these apps caught your attention, you should install them right away because they were all selected from a pool of apps after receiving careful evaluations to ensure that you receive only the best experience.

- Now, whether you already have an app or are developing one, you can also get it evaluated and placed on these sites.

- It will benefit your app from a marketing standpoint, and you will also be able to determine the app’s true potential.